BITCOIN VOLATILITY RESULTS IN FINANCIAL THREAT

Bitcoin is the most demanded cryptocurrency, as it has proven to be a virtual currency that has carved out its path. The majority of large investors worldwide do incline towards this cryptocurrency.

One of the digital currencies that provide the most outstanding security is Bitcoin, which operates under blockchain technology, providing agility, reliability, and immediacy when performing operations or trading.

Its volatility depends solely and exclusively on the environment’s trends that surround it, making it highly vulnerable.

Origin of bitcoin volatility

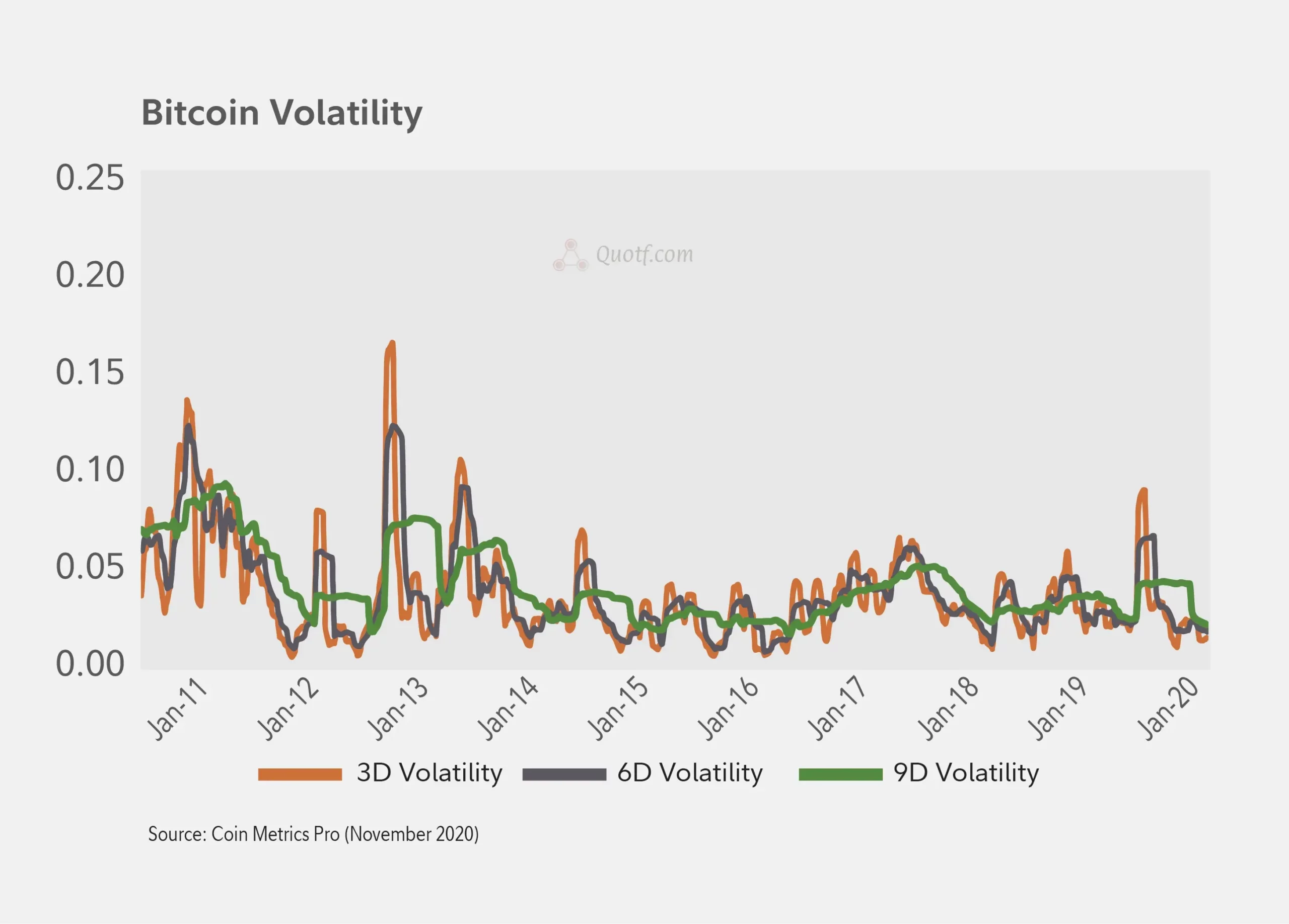

Cryptocurrencies, in general, have a significant disadvantage, which is their volatility. This aspect has caused panic among investors since price value variations change considerably, causing substantial losses.

Supply and demand are responsible for the volatility of the price of Bitcoin. This characteristic causes controversy in the markets since it is not very advantageous to invest in a cryptocurrency that does not have financial stability.

Basic characteristics of investors in bitcoin

People who want to invest in Bitcoin must open their minds to radical changes at unexpected times. Be ambitious, not afraid of losing, be optimistic, cheerful, futuristic, risky, and above all, interested in learning more every day about the development of this world of markets and virtual currencies.

How significant is the threat of volatility

The stability and profitability of the crypto markets are the fundamental basis for the success of their financial and economic stability worldwide.

It is remarkable to observe how many people trust that cryptocurrencies are the future; they are the most realistic possibility to achieve economic growth with Bitcoin, even if they represent fraud and unexpected loss.

Bitcoin should not do see as a risk due to volatility; these variations are standard in all traditional markets and stock exchanges worldwide. Furthermore, cryptocurrencies have shown low and significant variations in their assets and therefore do not represent a threat to the economy.

On the contrary, the price variations in Bitcoin should be taken as investment opportunities because it takes advantage of buying these coins cheaply and in greater quantity and then waiting for the increases where the revaluations are very significant and incredibly productive.

The economy is taking a transcendental turn, implementing cryptocurrencies in most virtual operations and negotiations.

More and more businesses are joining this project to achieve financial freedom and the decentralization of the global economy.

Conclusion

Bitcoin is the cryptocurrency that will become the most popular and profitable in the coming years, and its volatility will be an aspect to analyze and understand rather than a threat to the economy.

You have to be clear about what you want to obtain and not risk more than you don’t want to lose when it comes to investing. If these convictions do-follow, results will be successful, just as they have done shows throughout the history of Bitcoin.

For this coming year, 2022, it is expected that the most popular and quoted cryptocurrency will be Bitcoin, which is estimated to reach prices of over $100,000.

The metaverse will be the fundamental base to reach the long-awaited price; this new virtual world will bring many benefits for all people in general, giving the possibility of obtaining economic gains with the interaction with this unique digital space.

If you want to make investments in cryptocurrencies, do not see Bitcoin in particular because of its price variation as a threat to the economy. On the contrary, it can consider the most lucrative investment of all types; you have to determine that these investments in cryptocurrencies are based on studies and market analysis to decide on their possible behavior.

We must take advantage of ingenuity and technology to make our profit, and crypto is those opportunities that digitally provide us with assets and profits to strengthen the particular economy. Which will not depend on financial or government institutions; we will be autonomous and decentralized with the possibility of access and operating from any place and time.

Bitcoin, more than a threat, is the face of fortune, the door that gives way to a new life full of success and opportunities; entering this world is opting for the possibility of improving the habit of doing business and investing in something where the results are satisfactory and genuine.